Sold Put Strike - Total Net Credit = 130 - 0.70 = $129.30 (Maximum Difference in Strikes - Total Net Credit) (Diff in Strikes Bull-Put Spread OR Diff in Strikes Bear-Call Spread whichever is greater) - Net CreditĮxample: Index $XYZ at $146.32 per share.Įnter a 120 and 130 strike Bull Put Credit Spread:Įnter a 160 and 170 strike Bear-Call Credit Spread: (Total Net Credit ÷ Margin for the spread) * 100Ĭredit from Bull Put Spread + Credit from Bear Call Spread The return calculations for the Iron Condor Spread are: % Assnd = risk is the difference in strike prices on either spread minus the net credit. The lower break even is the sold put strike price minus the total net credit.Ī profit is realized at any price above the lower break even or below the upper break even at expiration.

#Iron condor options plus#

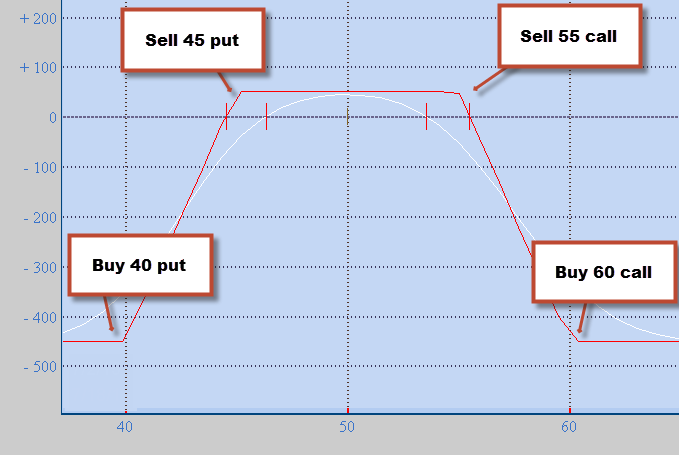

The upper break even is the sold call strike price plus the total net credit. profit is earned if the stock price remains above the sold put strike and below the sold call strike. You receive a net credit from both positions. Buy a Put one or more strikes lower than Sold Put in the same target month). Buy a Call one or more strikes above sold Call in the same target month).Įnter a Bull-Put Credit Spread in the same month, on the same stock (Sell a Put at or out-of-the-money. A profit is made if the stock remains above the lower break even point or below the upper break even point.Įnter a Bear-Call Credit Spread (Sell a Call at or out-of-the-money. Since there are two spreads involved in the strategy (four options), there is an upper break even and a lower break even. By doing this, an investor will potentially be able to double the credit obtained over a single spread position. In the Iron Condor, an investor will combine a Bear-Call Credit Spread and a Bull-Put Credit Spread on the same underlying security. The Iron Condor Spread strategy is a neutral strategy similar to the Iron Butterfly. Most investors trade Iron Condor Spread strategies on the indexes as there is lower chance of a sudden change in price. The maximum risk is equal to the differences in strike prices on one side of the spread minus the net credit.

The maximum profit is achieved if the stock stays between the short (sold) call and the short put strike prices. Iron Condor Spread is a neutral strategy. Combine an out of the money Bear Call Credit Spread and Bull Put Credit Spread on the same stock or index with the same expiration for all options.

0 kommentar(er)

0 kommentar(er)